The House of Representatives passed the American Health Care Act (AHCA) on May 4, 2017, providing the most comprehensive picture yet of what Republican health reform might look like. The Congressional Budget Office (CBO) cost estimate was released May 24, 2017, noting that the bill would lead to a significant increase in the number of uninsured people (23 million by 2026) and a significant cut in federal support for Medicaid ($834 billion over 10 years). Though the AHCA is unlikely to pass the Senate in its current form, parts of the bill could squeak through Congress and become law. What should state policy makers know about potential effects of AHCA on their state?

1. The AHCA would make it harder for people to obtain health care coverage

Before the Affordable Care Act (ACA), the health insurance landscape was filled with holes when it came to availability of coverage for certain populations. If a person without access to job-based coverage had a pre-existing condition, or was low–income and didn’t fit into a narrow Medicaid category, that individual faced high-priced insurance or no coverage options at any price. The ACA patched these holes (somewhat imperfectly) by expanding Medicaid, requiring large employers to offer coverage, and making the private market friendlier to consumers. As a result, even with incomplete implementation of the ACA, coverage rates rose to a record high.

The AHCA would make it harder for people to get coverage. States could keep their Medicaid expansion, but federal funding for the expansion would dramatically decrease, increasing the state obligation. In addition to Medicaid expansion cuts, AHCA makes long-term changes to Medicaid financing which would erode the program over time. Since Medicaid began, states receive federal funds for Medicaid based on their population’s medical need — the federal government matches state funds expended on enrolled populations for necessary care.[1] As medical need rises (e.g., new cancer treatments), federal funding meets states at least halfway in addressing increased expenditures. The AHCA would decouple federal Medicaid funding from a state’s Medicaid population need, instead providing funding based on historical spend and enrollment. Per the CBO, federal outlays for Medicaid would be $834 billion less over the course of the next decade.

At the same time that the AHCA would decouple federal funding from medical need for the Medicaid population, it would also decouple federal subsidies from financial need for individuals seeking insurance on the private market. Currently, premiums on the Exchange are subsidized based on household income and the premiums charged in the person’s location.[2] Under the AHCA, premium tax credits would no longer rise as premiums increase or incomes decrease.[3] Other changes, such as the loosening of actuarial value standards and qualified health plan certification requirements, would make it harder for consumers to compare plans and ensure that they are buying comprehensive coverage.

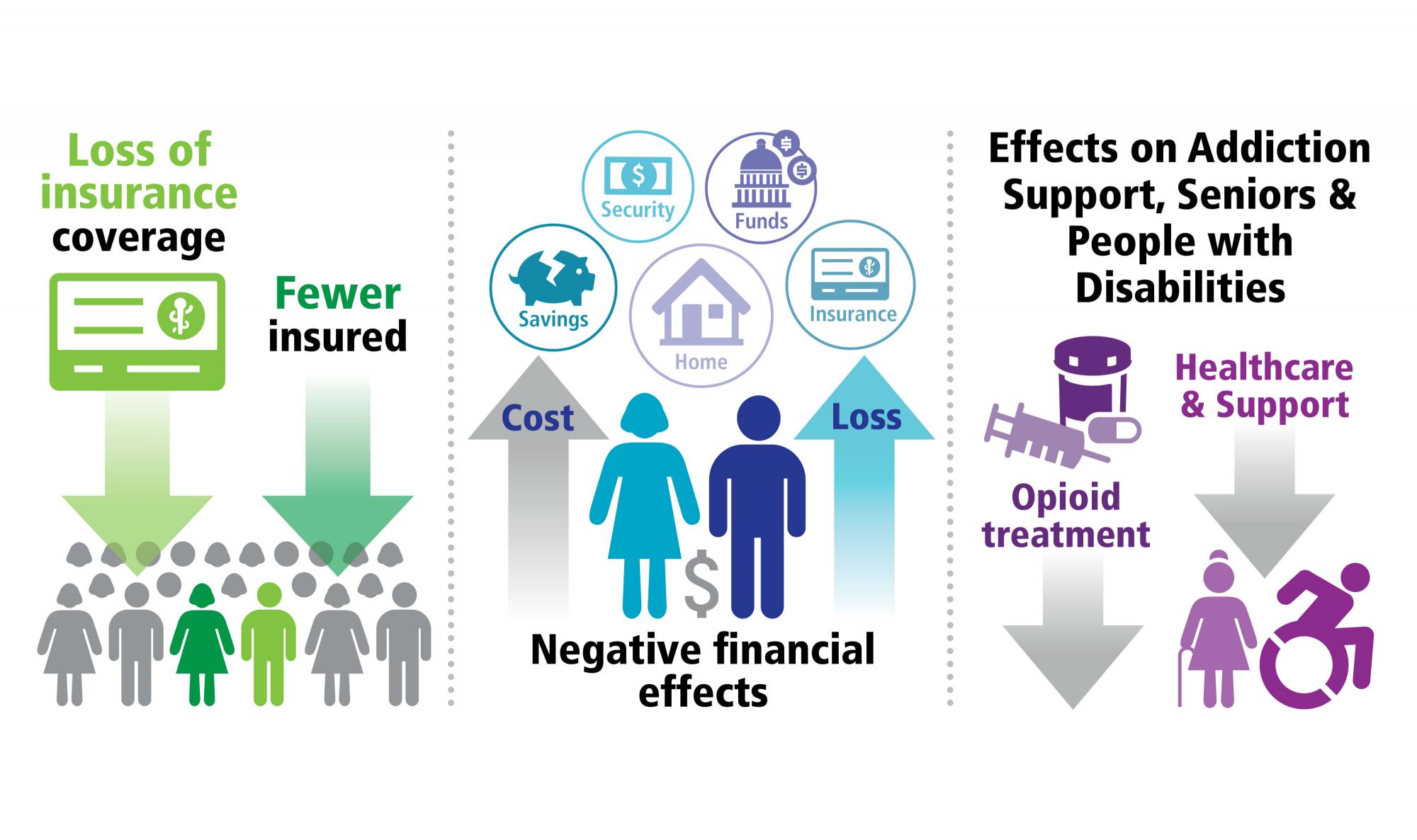

Under the AHCA, states would see health insurance coverage decline — by 14 million next year, and by 23 million in 2026. The CBO notes that this will affect low-income seniors age 50-64 disproportionately. Lower coverage rates, in turn, would likely lead to declining health outcomes and decreased financial stability for state residents. States that wish to maintain coverage levels could attempt to make up for the loss in federal funding for subsidies with state funding. This would increase pressure on state budgets, especially during economic downturns, when the demand for public and publicly-subsidized coverage grows.

2. The AHCA would derail state public health initiatives

States are facing multiple public health issues, from infectious disease to the opioid epidemic to a wave of baby boomers needing support in later life. As we discussed above, the AHCA erodes Medicaid funding, which acts as the backbone of public health initiatives — for providing coverage for check-ups, vaccines, long-term services and supports (LTSS), nursing home care, and addiction treatment. At the same time, the AHCA eliminates funding to states from the Prevention and Public Health Fund, which provides funding for states to address issues including the opioid epidemic, diabetes, obesity, vaccines, and epidemic prevention. With less Medicaid and public health funding, states would have less flexibility to meet the public health needs of residents.

3. The AHCA would affect state finances

States receive a significant amount of funding from the federal government, averaging more than 30% of state revenue.[4] The AHCA would decrease federal funding provided to states through Medicaid. Even if states make cuts to coverage and eligibility, states would still have an obligation to cover a “mandatory” population of residents under Medicaid if they participate in Medicaid at all, potentially leading to state shortfalls. Because the AHCA does not make any commensurate increases to state revenue, states would need to find revenue elsewhere (for example, through increased taxes), or reduce the services available in the state.

4. The AHCA would give more power to the state executive branch to make sweeping changes to the health care market without input from the state legislature

The MacArthur Amendment, added to the AHCA in May, contains waiver opportunities for states to change the health care market — by diminishing some pre-existing condition protections, for example. Unlike other ACA waivers, however, these MacArthur Amendment waivers do not require state authorizing legislation, additional stakeholder input, or evidence of a robust replacement plan, as do other ACA waivers. Thus, under the AHCA, states may see swift changes made to their individual market by their executive branch.

Conclusion

The AHCA would provide less money for states and low-income individuals to cover health insurance. Reducing funds for Medicaid and low-income subsidies on the individual market will result in less flexibility for states to cover vulnerable populations.

[1] There are exceptions to this rule (e.g. additional funding to promote delivery system reform), but the basic principle of federal funding based on medical need of the enrolled population remains.

[2] Subsidies (premium tax credits) are calculated based in part on the premiums charged by the second lowest cost silver plan in an individual’s market.

[3] With the exception of an adjustment if taxpayer’s income exceeds $75,000 for an individual return or $150,000 for a joint return